If you’ve ever paid online with a credit card, then you’ve already experienced how a payment gateway works. In traditional finance, payment gateways act as middlemen: when you enter your card details to make a purchase, the gateway securely transmits that data to your bank for authorization, and then relays the confirmation back to the merchant to complete the transaction. It all happens so quickly and seamlessly that you barely notice it.

Cryptocurrency payment gateways serve a similar purpose—but for crypto. Instead of credit cards, these gateways handle payments made in digital assets like Bitcoin, USDT, and others. When a customer pays with crypto, the gateway processes the transaction in real time, confirms that the payment was successfully broadcast and recorded on the blockchain, and notifies the merchant. From the merchant’s perspective, accepting crypto can feel just as easy as accepting Visa or Mastercard, without needing to understand the technical complexity behind blockchain technology.

For example, if you buy a shirt online and choose to pay in Bitcoin, the crypto payment gateway verifies the transaction within seconds and confirms that the funds have been received. The merchant then has the option to either keep the Bitcoin or instantly convert it into fiat currency like USD. The whole process is smooth, fast, and user-friendly—just like any standard online payment experience, except the backend is powered by blockchain rather than banks.

Types of Cryptocurrency Payment Gateways

There are three main types of crypto payment gateways, each built for different use cases and levels of technical expertise. Let’s break them down:

1. Traditional Payment Gateways – Custodial Platforms

These gateways work much like traditional card processors. When a customer pays with cryptocurrency, the funds are first sent to the payment platform’s wallet—not directly to the merchant. Once the transaction is confirmed, the platform settles the amount with the merchant.

The advantage of this model is simplicity. Merchants don’t need to interact with the blockchain or manage private wallets. Everything is handled by the provider.

But there’s a trade-off: since the funds are held by the platform before settlement, merchants are entirely dependent on the provider’s trustworthiness. If the provider delays payouts, withholds funds, or worse—disappears with the money—merchants have little recourse. That’s why it’s critical to choose only well-established providers with a solid reputation.

2. Web3 Payment Gateways – Smart Contract-Based & Non-Custodial

Web3 gateways are a newer, decentralized approach. Instead of relying on an intermediary, funds are sent directly to a merchant’s smart contract wallet. The payment platform doesn’t have access to the funds at any point during the transaction.

You might be wondering: if the platform can’t touch my funds, how does it charge fees? The answer is simple—merchants prepay fees by depositing a small balance (e.g., 10 USDT) into the platform account, which is then deducted as payments are processed.

This model offers maximum security. Because merchants have full control over their funds and smart contracts automate the payment process, there’s no risk of fund seizures or settlement delays. Web3 gateways are becoming increasingly popular for this reason—they combine transparency, security, and automation in a way that traditional systems can’t match.

3. Self-Hosted Payment Gateways – Fully Customizable but Technically Demanding

For businesses with in-house technical teams and very specific needs, self-hosted gateways offer the ultimate in flexibility and control. These are typically open-source projects that merchants install on their own servers.

Since the system is self-managed, there are no transaction fees and no third-party intermediaries involved. You can customize every aspect of the payment flow.

However, this freedom comes with a cost: you’re entirely responsible for system security, software updates, and infrastructure maintenance. Without a skilled dev-ops team, the risks can outweigh the benefits. This setup is best suited for technically mature businesses with complex or high-volume payment needs.

Top 5 Cryptocurrency Payment Gateways (Recommended)

Now that we’ve explored the types of gateways available, here are five trusted providers—each with unique advantages—worth considering depending on your business size and technical capacity:

| Product | Type | Fees | KYC Required | Recommendation |

|---|---|---|---|---|

| BlockATM | Web3 (non-custodial) | 2 USDT per transaction | No | ⭐⭐⭐⭐⭐ |

| BVNK | Traditional | Undisclosed (high-volume only) | Yes | ⭐⭐ |

| BitPay | Traditional | 2% + $0.25 / txn (tiered) | Yes | ⭐⭐⭐ |

| BTCPay Server | Self-hosted | No platform fees | No | ⭐ |

| Coinbase Commerce | Traditional | 1% per transaction | Yes | ⭐⭐⭐⭐ |

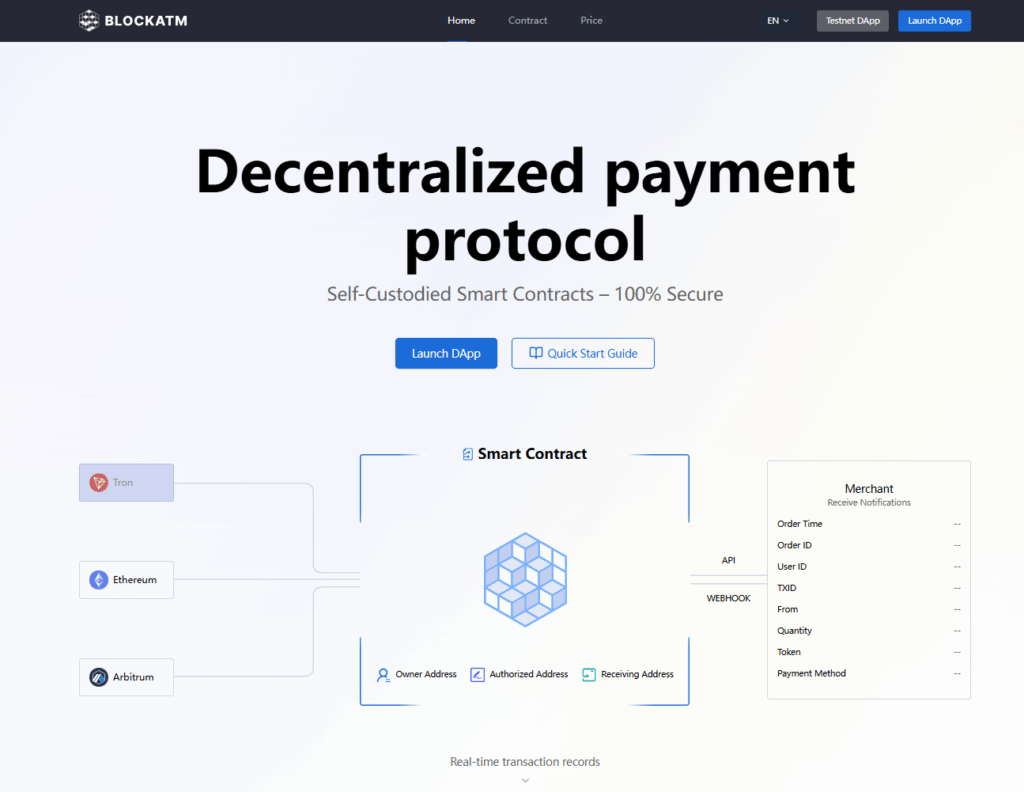

1. BlockATM

Built by our team as a Web3-native solution, BlockATM is designed to provide truly decentralized, secure crypto payments for businesses.

As a non-custodial gateway, BlockATM routes funds directly into your smart contract wallet. The platform never touches your money. Merchants can integrate seamlessly into their websites or apps, while enjoying full control over the funds at all times.

Fees are fixed—just 2 USDT per transaction, regardless of transaction size. To use the service, merchants simply pre-load their BlockATM account to cover future fees.

2. BVNK

Headquartered in London and launched in 2021, BVNK offers a full suite of crypto payment tools aimed at enterprise clients. In just a few years, BVNK has processed over $6 billion annually.

It operates as a traditional, custodial gateway, meaning it temporarily holds customer payments before forwarding them to the merchant. BVNK is best suited for large clients—it only accepts businesses processing at least €500,000 in monthly volume. Pricing is not publicly listed.

3. BitPay

BitPay, founded in 2011 and based in Georgia, USA, is one of the most established crypto payment providers on the market. It has handled over 10 million transactions worth more than $5 billion.

BitPay charges fees based on monthly volume:

- Under $500,000/month: 2% + $0.25

- $500,000–$1 million/month: 1.5% + $0.25

- Over $1 million/month: 1% + $0.25

Like BVNK, BitPay is a custodial gateway. While its reliability is well-regarded, its fees are among the highest.

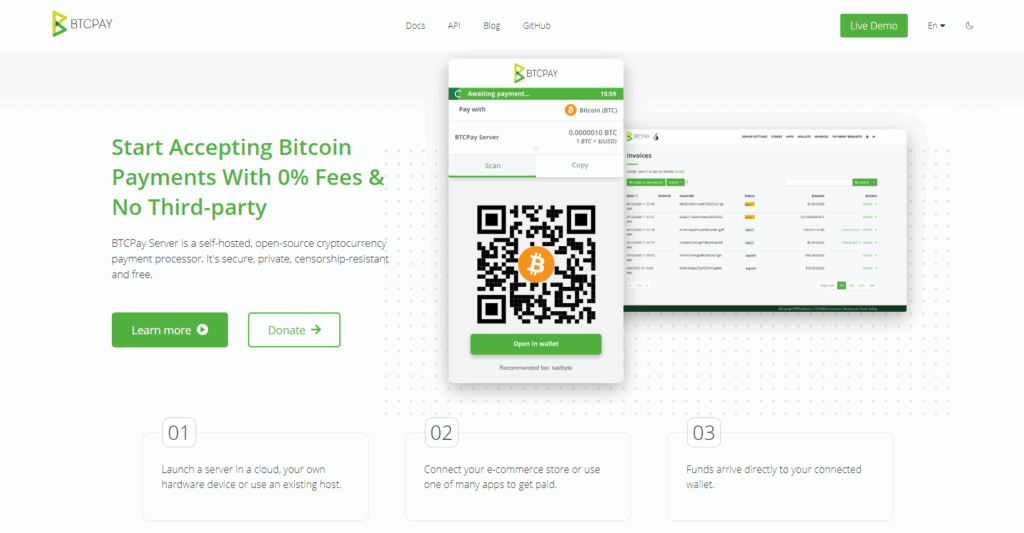

4. BTCPay Server

BTCPay Server is an open-source, self-hosted payment system built primarily for Bitcoin. It gives businesses complete control over their payment infrastructure—no intermediaries, no fees, and no KYC.

However, it only supports Bitcoin (no USDT or altcoins), and requires merchants to set up and maintain their own server infrastructure. It’s ideal for developers or companies with strong technical teams that want full control.

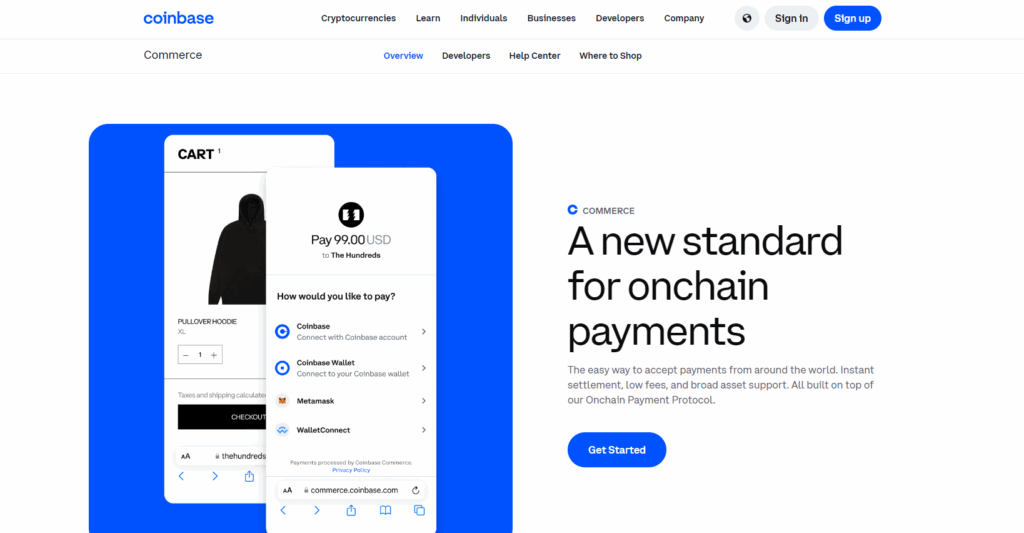

5. Coinbase Commerce

Most people know Coinbase as a crypto exchange, but it also offers a payment gateway solution. Coinbase Commerce supports over 10 major cryptocurrencies, including BTC, ETH, and USDT.

It charges a flat 1% fee per transaction and operates in a traditional custodial model—funds go to a Coinbase wallet first before the merchant can access them. Still, it’s a convenient and trusted option, especially for businesses already familiar with the Coinbase ecosystem.